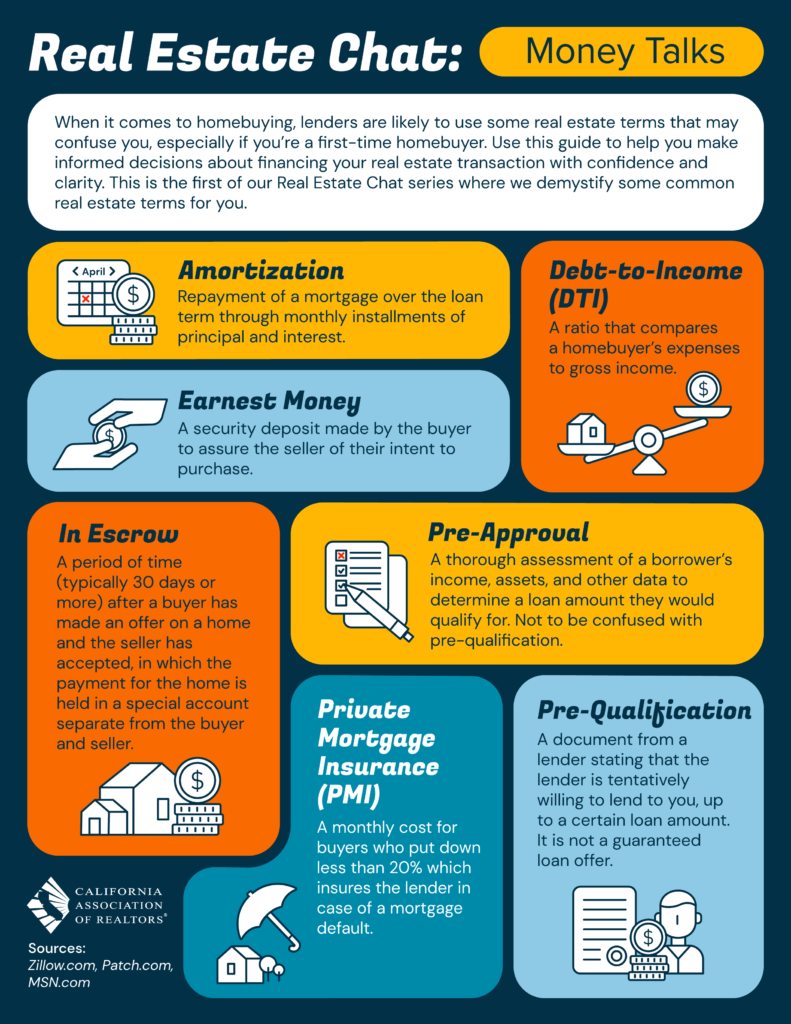

When it comes to homebuying, lenders are likely to use some real estate terms that may confuse you, especially if you’re a first-time homebuyer. Use this guide to help you make informed decisions about financing your real estate transaction with confidence and clarity. This is the first of our Real Estate Chat series where we demystify some common real estate terms for you.

Amortization

Repayment of a mortgage over the loan term through monthly installments of principal and interest.

Debt-to-Income (DTI)

A ratio that compares a homebuyer’s expenses to gross income.

Earnest Money

A security deposit made by the buyer to assure the seller of their intent to purchase.

In Escrow

A period of time (typically 30 days or more) after a buyer has made an offer on a home and the seller has accepted, in which the payment for the home is held in a special account separate from the buyer and seller.

Pre-Approval

A thorough assessment of a borrower’s income, assets, and other data to determine a loan amount they would qualify for. Not to be confused with pre-qualification.

Pre-Qualification

A document from a lender stating that the lender is tentatively willing to lend to you, up to a certain loan amount. It is not a guaranteed loan offer.

Private Mortgage Insurance (PMI)

A monthly cost for buyers who put down less than 20% which insures the lender in case of a mortgage default.

From: California Association of Realtors – car.org

Sources: Zillow.com, Patch.com, MSN.com